Why mortgage lenders are going to be revamping processes

When Nationale-Nederlanden Bank, the fifth largest Dutch bank, said at Celonis World Tour 2022 that it was deploying process mining for its mortgage origination and servicing businesses it highlighted what's likely to be a trend.

Mortgage companies have moved to trim budgets and expenses as interest rates rise globally. In the US, Federal Reserve moves to raise interest rates have curbed mortgage origination and refinancing applications.

Historically speaking, housing market turbulence has required mortgage companies to transform operations to compete in new market realities. Clearly, the market has changed.

Simply put, the US mortgage market is facing challenges it hasn't seen in more than a decade. Refinancing applications have fallen, and housing sales are starting to sputter.

Here's a tour of mortgage companies and their plans to boost efficiency.

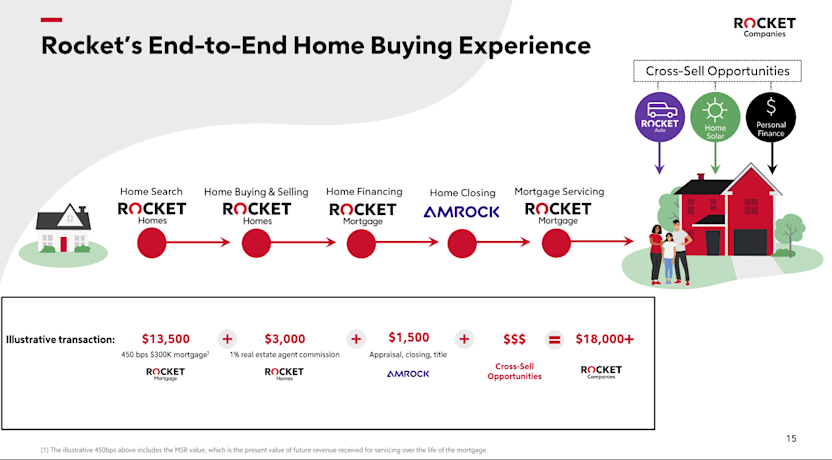

Rocket Companies

Rocket Companies CEO Jay Farner said on the company's first quarter earnings conference call that the mortgage industry is entering a new phase that will require new approaches, processes and operations. So far, Rocket Companies has implemented a voluntary career transition program, renegotiated contracts, reduced production costs and shifted marketing spending.

"We're in the third inning here of this process and one that we've lived through before, certainly back in 2008, 2009, 2010. We saw little glimpses of this in '14 and '19. But something that you've got to have a long-term view while you're taking short-term actions to ensure that the company is set up for success."

Farner said Rocket Companies is playing offense with performance marketing and its technology platform, but also defense. "Get your expenses in order. And ensure that you've got a tight grasp on everything you're spending and it's the right place to put your dollars," said Farner.

The trick for Rocket Companies is to preserve platform expansion into new services such as Truebill, Rocket Homes and Rocket Auto while managing through the interest rate and inflation turmoil facing Rocket Mortgage.

Mr. Cooper Group

Mr. Cooper Group is a mortgage company that has a large servicing unit. Jesse Bray, CEO of Mr. Cooper Group, outlined the challenges on its first quarter earnings call.

The first quarter was extremely volatile with the conflict and humanitarian crisis in Ukraine shocking the markets, further supply chain disruptions, leading to headaches for many industries, accelerating inflation, forcing the Fed into action and the sharpest increase in mortgage rates in many years, if not decades. And really all of this has pushed the originations industry into a period of severe retrenchment."

Bray added that the company's balanced portfolio offers some insulation, but Mr. Cooper Group is also looking to become more efficient with an automation effort called Project Flash. In February, Mr. Cooper Group said that Project Flash digitizes the mortgage application process and cuts processing time as much as 50%.

Christopher Marshall, President of Mr. Cooper Group, said the company is looking to automate the mortgage process.

"We're making extremely good progress with Project Flash, which further automates our middle office processes and continues to reduce our cost to originate," said Bray.

UWM Holdings

UWM focuses on wholesale mortgages and brokers with a technology platform that can speed up the closing process.

Mathew Ishbia, CEO of UWM Holdings, said on the company's first quarter earnings conference call that it wasn't going to cut expenses dramatically and acquire talent leaving rivals.

"The question you're asking is, how can we do when others don't? It's because of technology. Technology and efficiencies. We're going to be extremely profitable as long as we continue to run our business the way we run it with the purchase market. Everyone else has been so dependent on a refinance for so long that their costs were bloated. And so, they had to reduce that. We did not do that. We did not scale up the people, because of our technology didn't require us to do."

Ishbia's argument for UWM's resilience is that the company is focused on home purchases instead of refinancing. The complexity behind a home purchase often includes a borrower, a lender, realtors, appraisers and often two title companies. "There are a lot of nuances," he said.

According to Ishbia, UWM is playing the long game. "Let's say I saved $120 million over the next 2 years. Well, if I keep my team members, I do a great job supporting them, build the culture that we've built. You know what happens in July of 2024, rates go down a little bit. I make an extra $400 million that month. So, I saved $200 million over the last 2 years, and you're high-fiving me, but you don't realize, I mean, I didn't make $400 million in July of 2024. That's how I run the business," he said.